when will the 8915 e tax form be available

You will enter 23 on your 2021 return 13 will carry forward to 2022. This form replaces Form 8915-E for tax years beginning after 2020.

Solved Irs Form 8915 E Intuit Accountants Community

Click Taxpayer Qualified 2020 disaster retirement plan distributions and repayments Form 8915-E.

. When will form 8915-E be update and available for 2021 tax year. Personal state programs are 3995 each state e-file available for 1995. Form 4972 Tax on Lump Sum Distributions Taxpayer 03312022.

Form 4972 Tax on Lump Sum Distributions Spouse. TaxpayersSpouses Form 8915-E - Qualified 2020 Disaster Distribution There are several caveats. Tax Form 8915-E.

IRS Form 8915-F TurboTax is available under the Federal tab. The distribution must have been made before December 31 2020. Returning Client - 2020 return was previously done in the Desktop Program.

Form eligibility and data entry varies depending on the year of Drake Tax. E-file fees do not apply to NY state returns. Enter the total amount from your 1099-R forms and other information on the 8915 form.

Do not use a Form 8915-F to report qualified 2020 disaster Feb 11 2022 Cat. By Terry Savage on February 15 2021 Economy Taxes. Qualified Disaster Retirement Plan Distributions and Repayments Forms 8915 are available in Drake Tax.

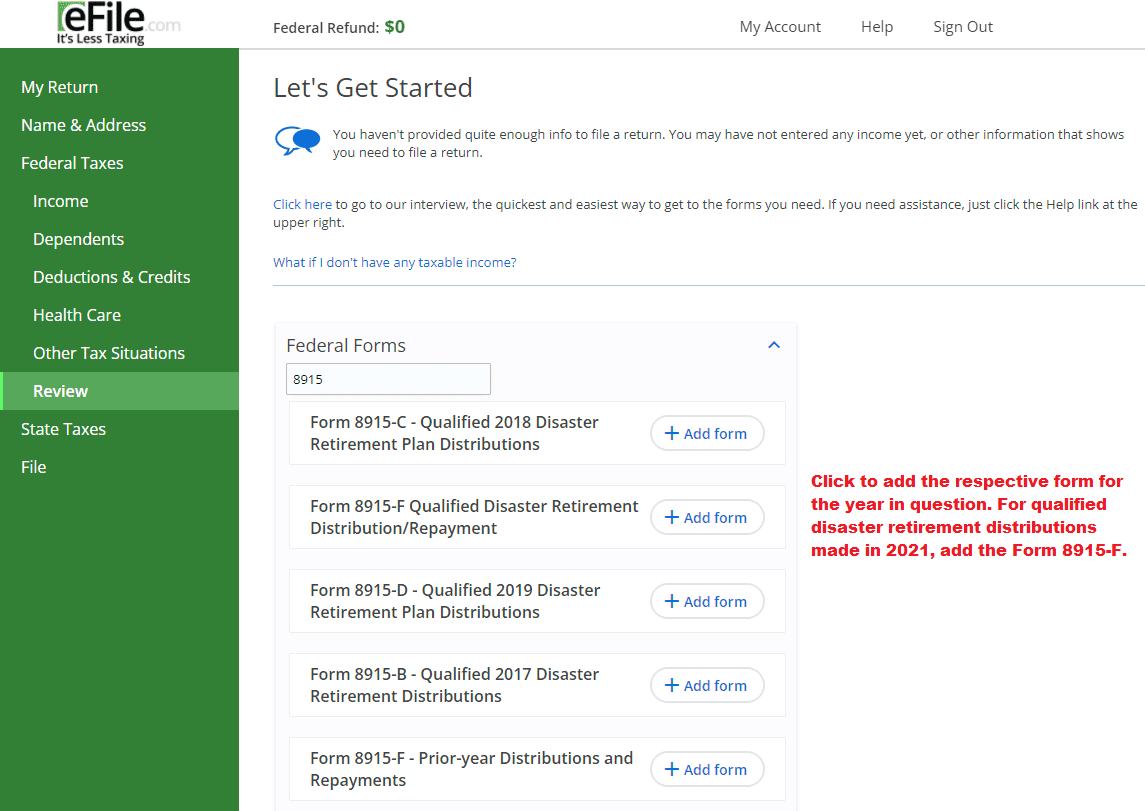

Enter 8915 and search. Currently the 8915-F is still in development and not yet available in ProSeries 2021. 37509G distributions made in 2020 or qualified.

Instructions for Form 8915-E Qualified 2020 Disaster Retirement Plan Distributions and Repayments Use for Coronavirus-Related Distributions 2020. In 2021 the form was available around February 26 2021. Fill Out Form 8915-F for the tax year 2022.

Recently many people have found their lives upside down out of work working less furloughed or experienced a natural disaster. When Will Form 8915-e Be Available For 2021. Hi Terry I need form 8915-E to complete and file my taxes.

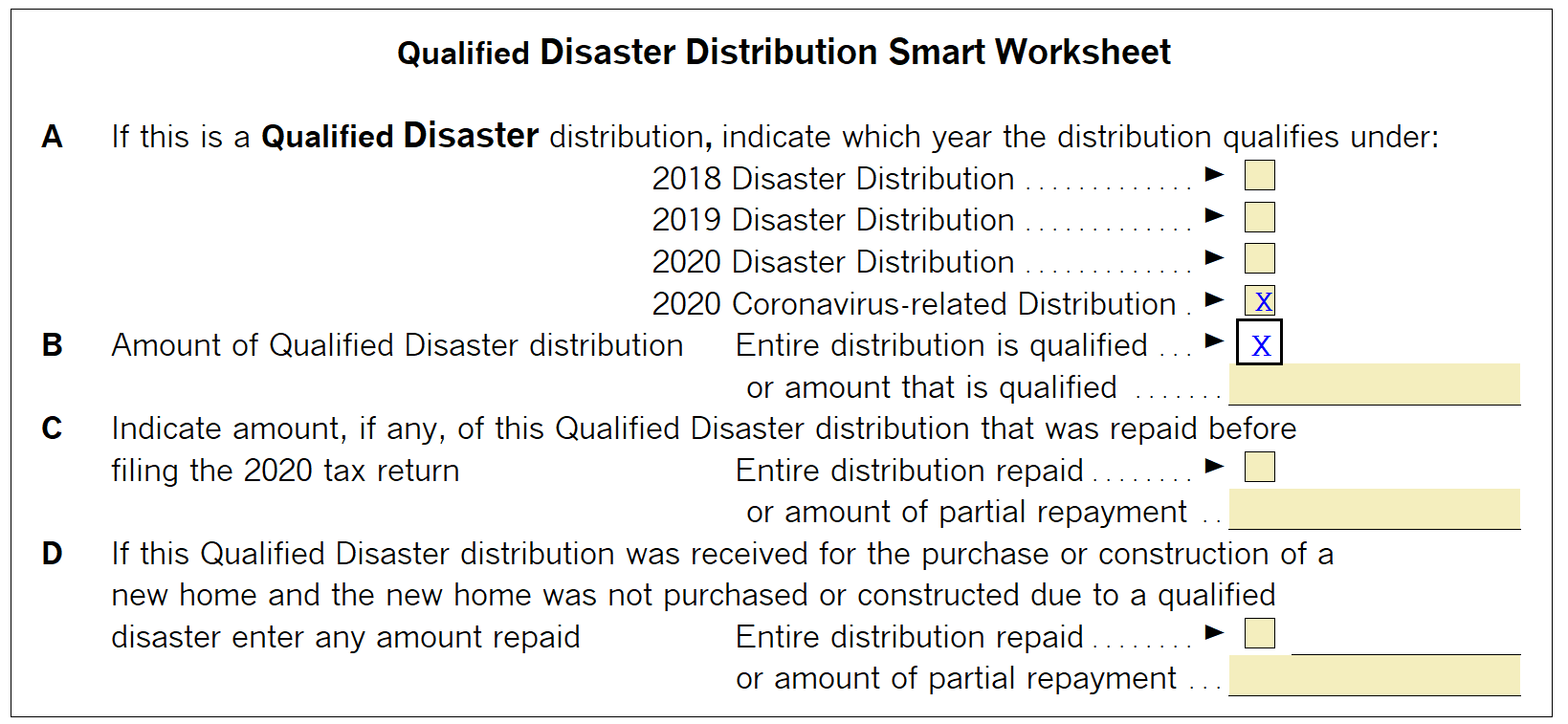

When will form 8915-E be update and available for 2021 tax year. If do not want to spread the distribution over a 3 year period you will need to check the box next to Elect NOT to spread the taxable amount over 3 years Please Note. The taxable amount will be removed from the 1099-R and placed on the 8915-E per IRS guidelines.

You will create this form 8915-F in the program under the. From within your TaxAct return Online or Desktop click FederalOn smaller devices click in the upper left-hand corner then click Federal. The form was initially launched in 2020 to meet the qualified disaster treatment of people who provide repayments on a three-year tax portion.

Click Retirement Plan Income in the Federal Quick Q. This article discusses Drake21. Qualified 2020 Disaster Retirement Plan Distributions and Repayments 2020 Inst 8915-E.

I just read that it will not be available until March. To enter or review Form 8915-E information. Instructions for Form 8915-E Qualified 2020 Disaster Retirement Plan Distributions and Repayments Use for Coronavirus-Related Distributions 2020.

State e-file not available in NH. However I understand the IRS has not yet released this form. Most personal state programs available in January.

Please be aware that these instructions are only if you previously filed the 8915-E on your 2020 return. Information about Form 8915-E Qualified 2020 Disaster Retirement Plan Distributions and Repayments Use for Coronavirus-Related and Other Qualified 2020 Disaster Distributions including recent updates related forms and instructions on how to file. When Should I Not Use a Form 8915-F.

The IRS has issued new Form 8915-E which individual taxpayers must file with their income tax returns to report coronavirus-related distributions and other qualified 2020 disaster distributions received from retirement plans in 2020 as well as. Do not re-enter the 2020 1099-R into the 2021 Form 8915-F. In my opinion it is the Professional Tax Preparers responsibility to.

Once Form 8915-F is available carryover amounts will need to be manually entered from the 2020 8915-E. If any certified individual is affected by any qualified disaster they can claim CRDs coronavirus-related disasters. Form 8915-F will ask for the necessary information from the 2020 Form 8915-E.

For those of us who took retirement distributions due to COVID-19 in 2020 and chose to pay taxes over 3 years form 8915-E should again be used for the 2021 tax year for the 2nd installment. Completing 8915-F for COVID Related Distribution. Release dates vary by state.

Form 8915-E is not available for use in the 2021 tax return and no plan distributions made on or after December 31 2020 qualify for treatment as a Coronavirus-related qualified disaster distribution. Reporting coronavirus-related and other distributions for qualified 2020 disasters made or received in 2020. State e-file not available in NH.

State e-file available for 1995. For information about Drake20 and prior see Related Links below. The watermark has been removed and Form 8915-F is available for e-file as of February 4 2022.

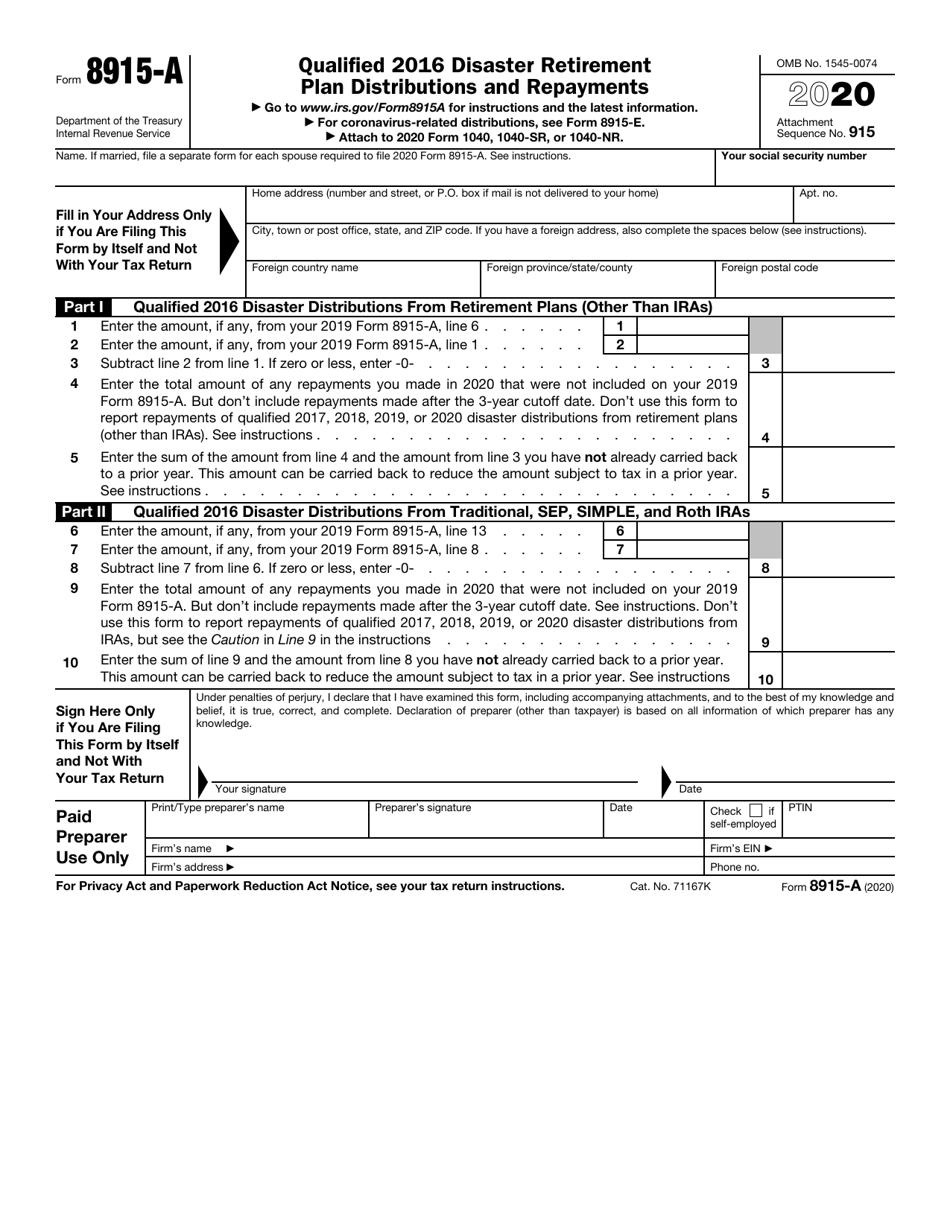

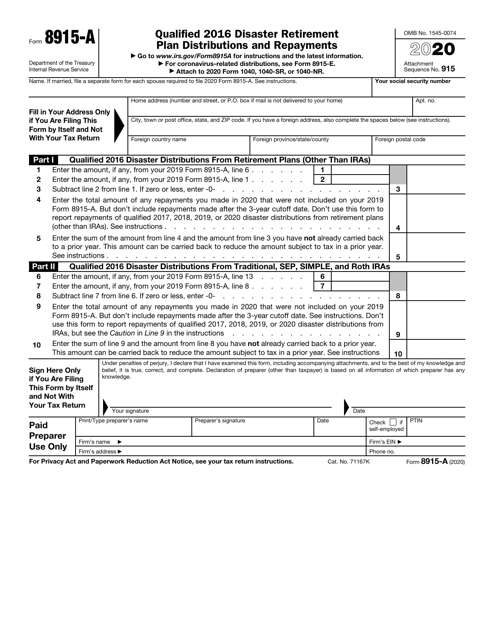

Form 8915-E for retirement plans. The program will carry your information to the 8915-E automatically. Qualified 2016 Disaster Retirement Plan Distributions and Repayments.

Form 1310 Stmt of Person Claiming Refund Due a Deceased Taxpayer. Form 8915-E has been replaced with a multi-year form Form 8915-F. You need to file a 8915-F both in 2021 and 2022 and show it being paid back across those two consecutive years.

Congress enacted relief to ease the financial burden of those incurring disaster losses or have suffered financially due to the Coronavirus. If you used Worksheet 2 in your 2020 Instructions for Form 8915-E the amount for line 1b is figured by adding together the amounts in column X line 4 of that worksheet for the disasters you reported on 2020 Form 8915-E that you are now reporting in item C of your 2021 Form 8915-F. Click on Federal Taxes on the left then on Review then on Id like to see the forms Ive filled out or search for a form on the right side.

Follow these steps to fill out the form on TurboTax. 27 days ago Taxpayer - US. For the most up to date information on the 8915-F status see ProSeries Release Dates.

For Form 8915-F click on Add Form. April 08 2021. If you filed Form 8915-E in 2020 because you took a retirement distribution due to COVID-19 hardship then the IRS will require you to file a 8915-F this year.

Coronavirus Related Distributions Via Form 8915

How To Pay Taxes Over 3 Years On Cares Act Distributions Tax Form 8915 E Explained Youtube

When Will 8915 E Be Available Turbotax 2022 Feb Find

Irs Form 8915 A Download Fillable Pdf Or Fill Online Qualified 2016 Disaster Retirement Plan Distributions And Repayments 2020 Templateroller

8915 F 2020 Coronavirus Distributions For 2021 Tax Returns Youtube

8915 F It Looks Like Isn T Released Yet R Taxpros

Generating Form 8915 In Proseries

8915 F 2020 Coronavirus Distributions For 2021 Tax Returns Youtube

When Will Form 8915 E 2020 Be Available In Turbo T Page 19

Form 8915 E For Retirement Plans H R Block

Irs Form 8915 A Download Fillable Pdf Or Fill Online Qualified 2016 Disaster Retirement Plan Distributions And Repayments 2020 Templateroller

When Will Form 8915 E 2020 Be Available In Turbo T Page 19

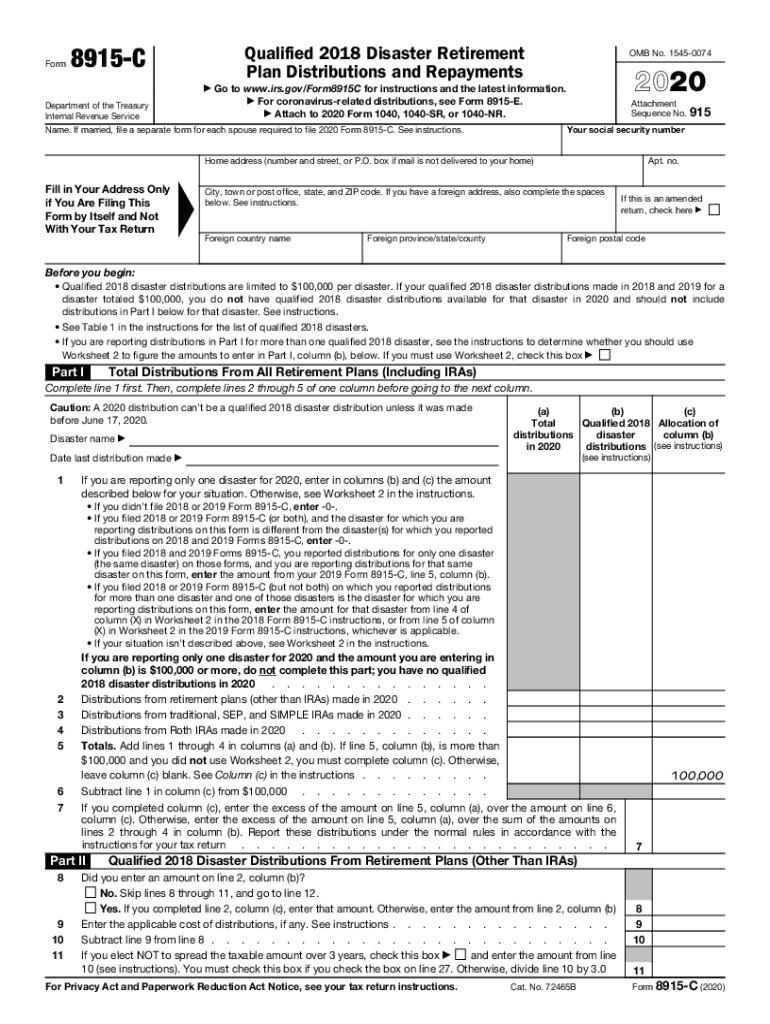

2020 2022 Form Irs 8915 C Fill Online Printable Fillable Blank Pdffiller

How To Report 2021 Covid Distribution On Taxes Update Form 8915 F Youtube